Fetching...

Fetching...

17 September 2024

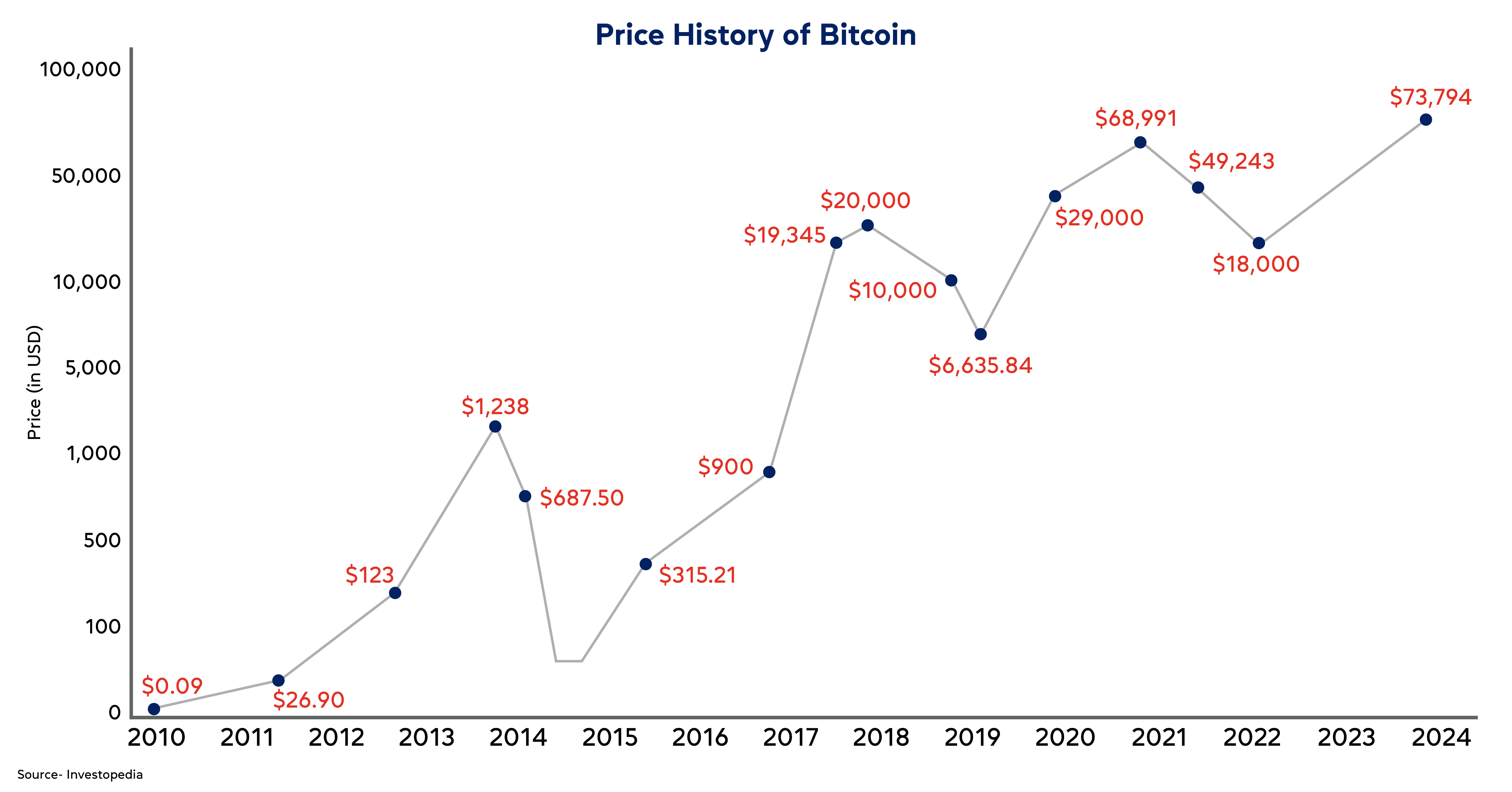

The rise of digital currencies is redefining investment opportunities. The dramatic increase in bitcoin’s value, which reached an all-time high exceeding $70,000 in March 2024, along with the substantial growth of cryptocurrency ETFs—surpassing $75 billion* in assets—have drawn significant attention from investors and regulatory bodies alike. This growing interest in cryptocurrency investment reflects the rising prominence of digital assets in today’s financial markets.1,2

While digital currencies offer the promise of substantial gains, they also present complex challenges for those navigating this evolving market. In this blog post, we will assess the investment potential of digital currencies, explore how they interact with traditional asset classes, and address the unique challenges investors face in this dynamic and often unpredictable market.

1.1 Skyrocketing Returns

Cryptocurrencies have come a long way since their humble beginnings. The first recorded transaction using Bitcoin occurred in 2010 when someone bought two pizzas for 10,000 bitcoins. Today*, those bitcoins would be worth about $550 million.3 This dramatic increase in value is just one example of the remarkable growth seen in the cryptocurrency market. In recent years, cryptocurrency investments have continued to capture widespread attention due to their impressive performance. From March 2019 to July 2024, the Indxx Cryptocurrencies 100 Index, which tracks the performance of the top 100 cryptocurrencies by market cap, has delivered an impressive cumulative return of more than 800%. Among these, bitcoin and ethereum stand out as the leaders, with bitcoin alone accounting for more than 50% of the total market capitalization of all cryptocurrencies.4 Their impressive performance is demonstrated by key achievements, such as:

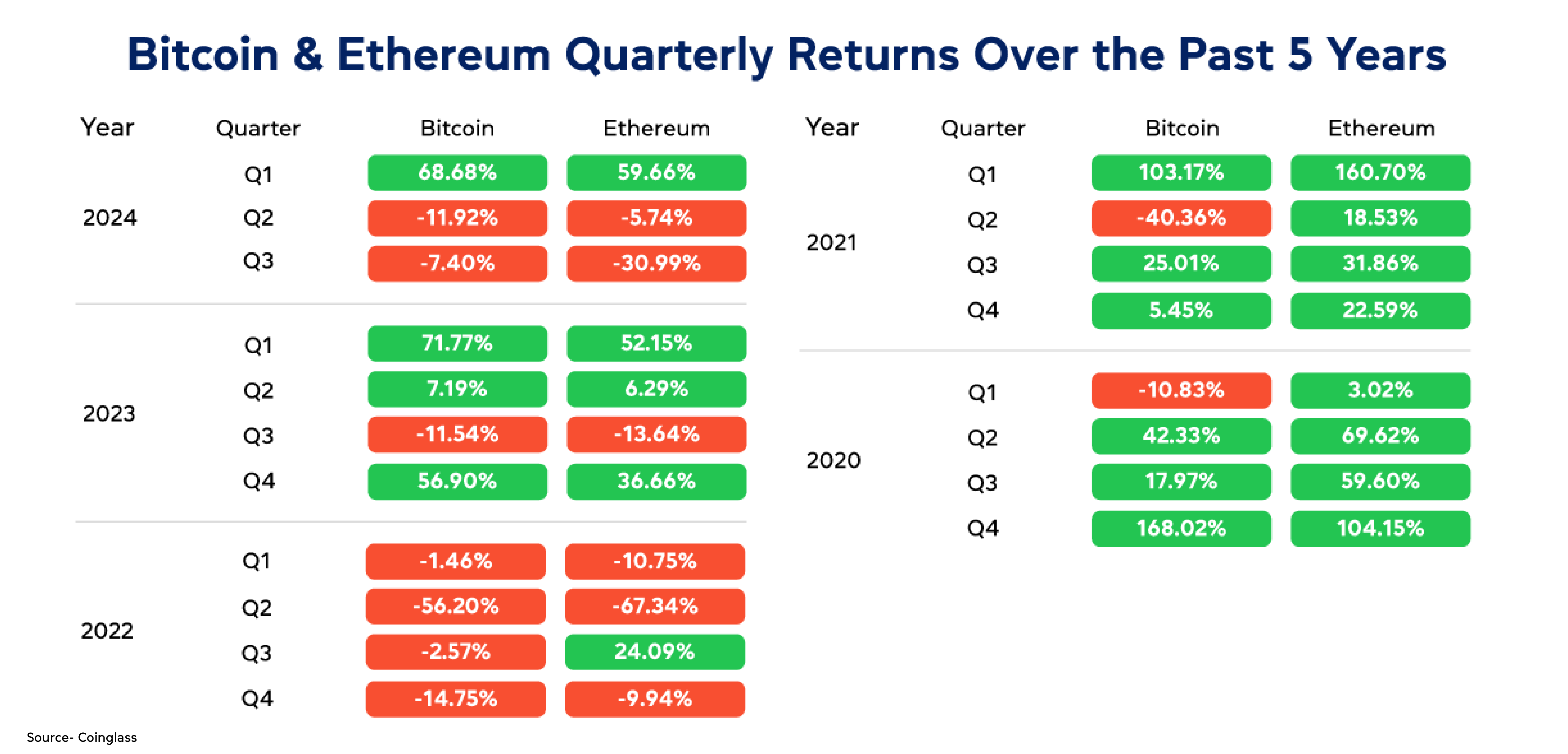

• In Q1 2024, bitcoin and ethereum both achieved gains of over 50%, reflecting their strong market performance.

• Similarly, in Q1 2021, these cryptocurrencies experienced gains of more than 100%, highlighting their potential for substantial returns.

What determines the price of cryptocurrencies?

The price of cryptocurrencies is influenced by several factors, including supply and demand dynamics, market sentiment, and external variables. Supply is affected by the total number of coins available and changes due to mechanisms such as mining rewards or protocol updates. For example, bitcoin’s supply is capped at 21 million coins by design.5 The closer bitcoin gets to this limit, the higher the price assuming all other factors remain constant. Demand, on the other hand, is shaped by investor interest, technological advancements, and broader market trends. Market sentiment, which can be swayed by news, regulatory updates, and social media, also plays a crucial role. Additionally, liquidity and trading volume on exchanges impact price stability and volatility. Together, these factors contribute to the constantly fluctuating prices of digital currencies.

1.2 Cryptocurrencies: A Unique Diversification Opportunity

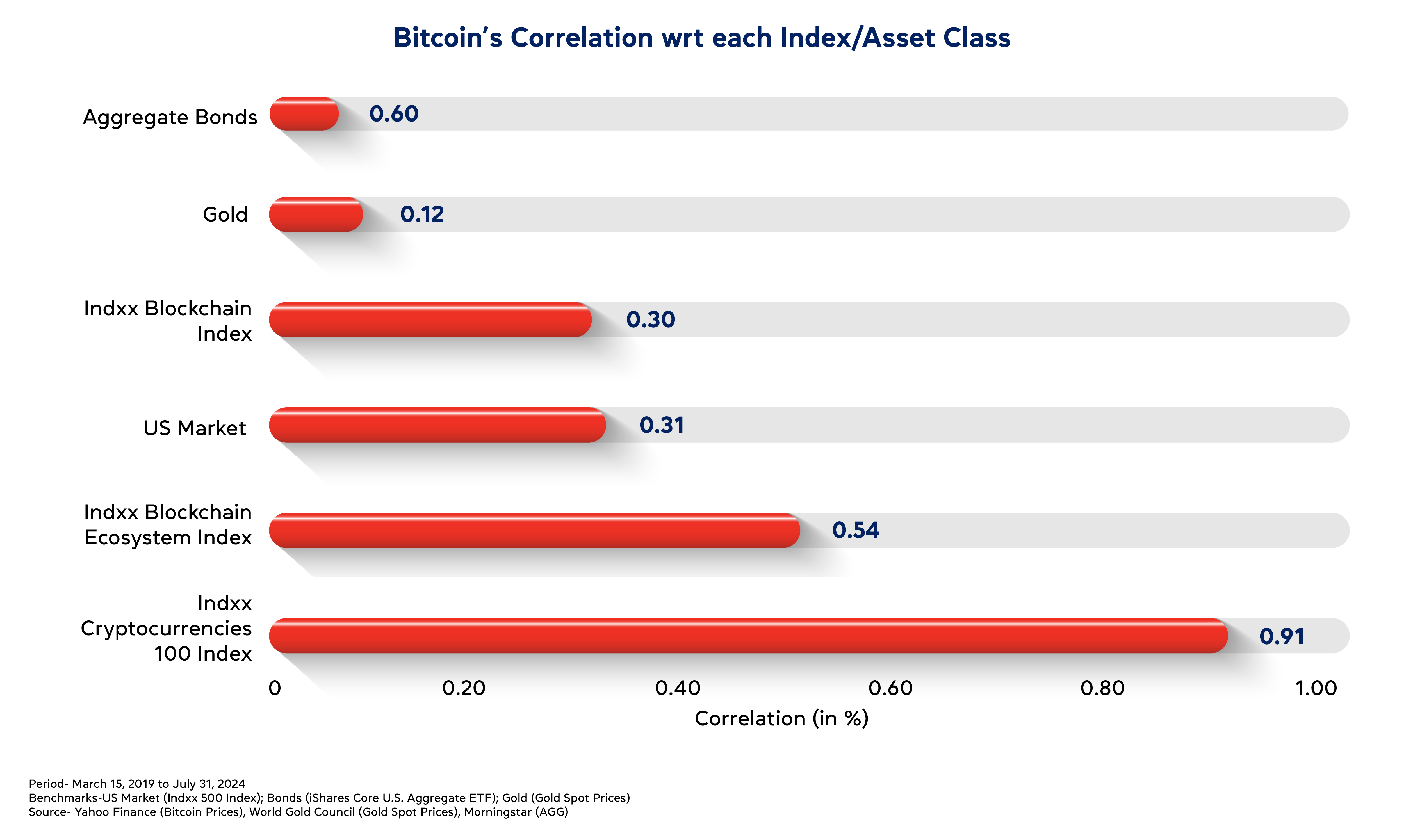

As a relatively new asset class, cryptocurrencies offer distinct diversification benefits compared to traditional investments such as stocks, bonds, and gold. An analysis by Indxx comparing bitcoin, the largest cryptocurrency, with various asset classes revealed that cryptocurrencies exhibit the lowest correlation with US aggregate bonds, followed by gold. Bitcoin's significant market dominance is also highlighted by its strong correlation with the Indxx Cryptocurrency 100 Index.

Furthermore, the cryptocurrency space itself is highly diversified. Various cryptocurrencies serve different purposes and utilize diverse technologies. For example:

• Bitcoin, often viewed as "digital gold", is primarily a store of value.

• Ethereum facilitates smart contracts and decentralized applications, which can be seen as a platform for innovation in decentralized finance (DeFi).

• Stablecoins like USDC or Tether are pegged to traditional currencies and aim to provide stability.

This diversity within the cryptocurrency ecosystem allows investors to diversify their holdings within the asset class itself.

Investing in cryptocurrency can be a double-edged sword, presenting both high rewards and significant risks. The crypto market is characterized by several significant challenges, including extreme volatility, regulatory uncertainties, liquidity issues, and technological constraints. Here’s a closer look at these risks:

• Volatility: Cryptocurrencies are known for their dramatic price swings. For instance, Bitcoin's value spiked to nearly $65,000 in late 2021, only to fall below $20,000 within a year.5

• Security: Cryptocurrency exchanges and digital wallets are prime targets for hackers. The 2014 Mt. Gox hack, which resulted in the theft of approximately 850,000 bitcoins valued at around $450 million at the time (equivalent to approx. $48 billion today*), highlights the security risks associated with digital assets.6

• Market Manipulation: The cryptocurrency market is vulnerable to manipulative schemes, such as pump-and-dump frauds, where scammers artificially inflate the price of lesser-known cryptocurrencies through deceptive tactics and coordinated purchasing, only to sell off their holdings at the inflated price. This leaves other investors stuck with devalued coins.

• Liquidity Issues: Not all cryptocurrencies can be easily converted into cash. The ease of converting a cryptocurrency depends on its presence across various exchanges. Lesser-known cryptocurrencies, often available on fewer platforms, may face liquidity problems, making them harder to sell quickly.

• Loss of Access: Unlike traditional bank accounts, cryptocurrency assets are accessed through private keys or passwords. Losing these can result in permanent loss of access to assets as there is no central authority to reset or recover them. Estimates from ReWallet** suggest that up to 20% of Bitcoin is trapped in lost wallets, amounting to around $237 billion as of March 2024.7

The future of cryptocurrency markets holds immense potential but also presents significant risks. As digital currencies continue to evolve, advancements in technology and regulatory frameworks will play a crucial role in shaping their trajectory. The development of clearer regulations and enhanced security measures will be vital in fostering a more stable and transparent market.

By aligning with regulatory developments, embracing technological advancements, and implementing robust risk management practices, stakeholders can navigate the complexities of the cryptocurrency market and position themselves for future success. As the market matures, its impact on global finance could be profound, making it an exciting area to watch in the coming years.

*Data as of September 04, 2024, Price of BTC $56,462.

**ReWallet is a crypto wallet recovery service that helps users regain access to their lost wallets.

1. Mint 2. TrackInsight 3. Investopedia 4. CoinMarketCap 5. Investopedia 6. LosAngeles Times 7. Yahoo Finance